Gain Insight from Nebo’s Robust Research

Welcome to Nebo’s Insights Page, your destination for gaining valuable insights into what is means to be a Nebo advisor. Explore the latest trends, expert opinions, and engaging content that shed light on how Nebo is reshaping the industry. Join us on this journey as we help advisors create personalized portfolios that align with their client’s financial goals.

Don’t miss our “Greatest Hits” section, a trilogy of White Papers about Investing for Retirement.

Investing for Retirement I: The Defined Contribution Challenge

by Ben Inker and Martin Tarlie The retirement landscape has…

Investing for Retirement II: Modeling Your Assets & Correcting the Flaws in Monte Carlos

Standard financial industry practice builds retirement portfolios using mean-variance optimization…

Investing for Retirement III: Understanding and Dealing with Sequence Risk

Sequence of return risk is entirely ignored in much of…

Nebo Insights are a collection of whitepapers, webinar recordings, and use case videos that help you understand where Nebo came from and how Nebo works.

The Future of Portfolio Construction is Goals-Based

Adam Scully-Power, Practice Solutions Director, Nebo Wealth at Schwab Impact…

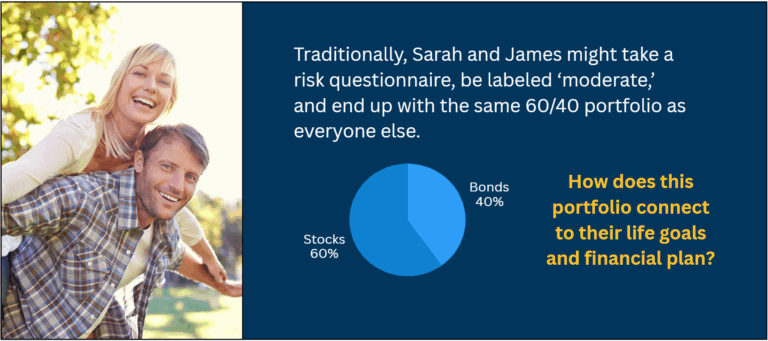

Where Are Goals in Risk Scores?

Why client lives can’t be reduced to a single number…

Addressing Compliance Risk

Why Is This Client in This Portfolio? Matt Kadnar, Sales…

Can a Leopard Change Its Shorts? Asset Allocation, Valuation, and Long-Term Investing on a Personal Scale

by Matt Kadnar and James Montier Asset allocation is crucial…

Beyond Risk Scores: The Key to Unlocking Personalized, Goals-Based Investing (Presented at T3 2025)

by Adam Scully-Power and Martin Tarlie In March 2025, we…

The Paradox of Choice in Model Marketplaces: Why More Options Are Making It Harder for Advisors to Deliver Better Outcomes

by Adam Scully-Power If you’re an advisor managing client portfolios,…

The Future of Goals-Based Investing: An Award-Winning Four-Step Process to Improve Investor Outcomes

by Adam Scully-Power. Most portfolios aim to beat benchmarks. But…

The Importance of a “Total” Portfolio View: Modeling a Client’s Small Business Ownership

by Matt Kadnar and Martin Tarlie. Incorporating privately held assets…

Risk Scores: Putting the Horse Behind the Cart

by James Montier, Martin Tarlie, and Matt Kadnar. The understandable…

The Perils of Outsourcing Asset Allocation to a Risk Score

by James Montier, Martin Tarlie, and Matt Kadnar. For too…

Dear Allocator: Is it OK to own 100% stocks?

by Ben Inker. We recently polled our Nebo clients: “What…

Monte Carlo Simulations – Details Matter

by James Montier, Martin Tarlie, and Matt Kadnar. Monte Carlo…

Your Own Worst Enemy II – Present Bias

by James Montier, Martin and Tarlie Matt Kadnar. People have…

Your Own Worst Enemy I – Framing and Nudges

by James Montier. We know from a behavioral perspective that…

Your Own Worst Enemy (Preface) – Darwin’s Mind: The Origin of Biases

by James Montier. The investor’s chief problem – and even…

Investing for Retirement III: Understanding and Dealing with Sequence Risk

Sequence of return risk is entirely ignored in much of…

Investing for Retirement II: Modeling Your Assets & Correcting the Flaws in Monte Carlos

Standard financial industry practice builds retirement portfolios using mean-variance optimization…

A Case Study in Multiperiod Portfolio Optimization: A Classic Problem Revisited

by Martin Tarlie. Foundational research: Most people in finance and…

Optimal Holdings of Active, Passive, and Smart Beta Strategies

by Edmund Bellord, Joshua Livnat, and Dan Porte. Foundational research:…

Investment Horizon and Portfolio Selection

by Martin Tarlie. Foundational research: we introduce a method of…

Who Ate Joe’s Retirement

by Peter Chiappinelli and Ram Thirukkonda. Retirement plan participants are…

Investing for Retirement I: The Defined Contribution Challenge

by Ben Inker and Martin Tarlie The retirement landscape has…