Rebalancing Public and Private Assets

At Charles Schwab IMPACT®, Adam Scully-Power, CIMA®, CPWA® was asked how we handle private market exposures that shift over time. His answer cut straight to the operational reality firms are wrestling with today.

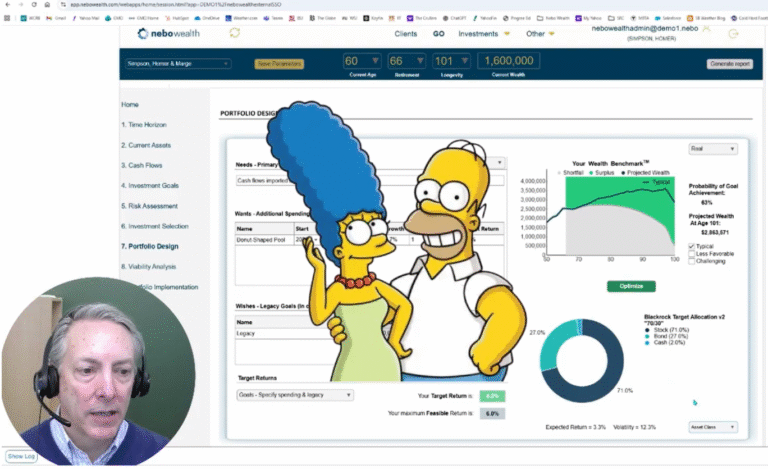

A common approach is to add “5 to 10 percent” privates directly into their existing models. The problem is that once those assets move, they can’t be rebalanced easily. Adam explains why, and why we believe the better approach is to keep the private sleeve separate and recalibrate the public sleeve around it through optimization so portfolios stay aligned with client goals.

If this is a topic your team is exploring, we’re always open to comparing notes.

#goalsbasedinvesting #privateoptimization #rebalancing