The Path to Personalization Through Behavioral Finance

Our favorite 5 key takeaways from “The Path to Personalization Through Behavioral Finance” on stage at the Datos Insights Wealth Management Forum 2025 with Adam Scully-Power, CIMA®, CPWA® Michael Liersch Edelman Financial Engines and Rose Palazzo Edward Jones:

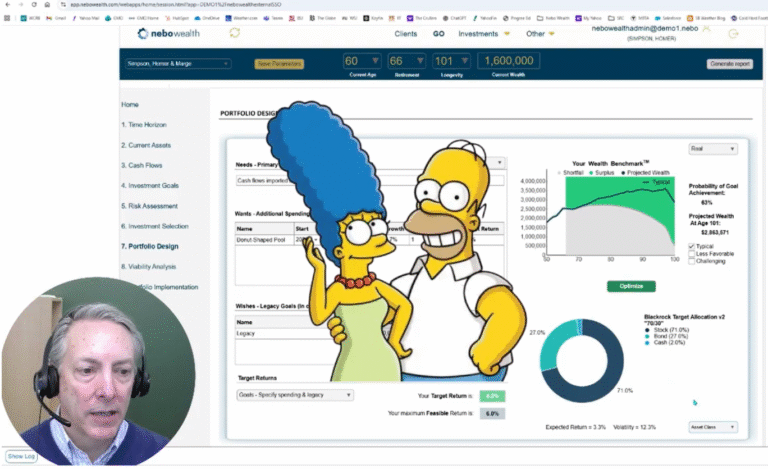

1. Personalized Wealth Benchmark™ is incredibly impactful

Clients stay more engaged when they track progress toward goals instead of broad market indices. As one panelist said, “If we’re going to talk about performance, we should talk about how you’re doing against your goals. Your money has a purpose and that should be part of the conversation.”

2. Be cautious of ‘over AI-ing’ or ‘over-digitizing’ things

People are at the heart of wealth management. Money issues are enormously personal. The reality is clients don’t want to trust a machine; they want talk to someone who can incorporate nuance in those discussions.

3. Planning-to-portfolio gap results in inconsistent advice

The challenge is a client can walk into an advisor in Boston and then meet another from the same firm in Los Angeles and get two very different portfolios. When that happens, they may start to question the process: “Wait a minute, this feels completely different from what I had before.”

4. “Freedom within a framework” unlocks the CIO

Firms can unlock their investment expertise by giving advisors freedom to tailor portfolios within guardrails. The CIO defines the pantry (models, asset classes, private assets) and Nebo builds the recipe that fits each client.

5. Solving the scalability paradox

We believe the solution is pairing a powerful optimization engine with a freedom-within-a-framework model that lets firms scale personalization without sacrificing quality or consistency.

#GoalsBasedInvesting #BehavioralFinance #Personalization

*Recorded live at the Datos Wealth Management Forum 2025. The discussion reflects the views of the speakers and is intended for informational purposes only. It should not be considered investment advice.*