A Systematic Approach to Private Markets in Client Portfolios

Private markets are becoming a core part of client portfolios, but most firms still rely on static allocations and rules of thumb. As high-net-worth investors increase exposure to private equity, private credit, and direct investments, firms are looking for a systematic way to integrate these assets alongside publics: accounting for liquidity, goals, and client-specific needs.

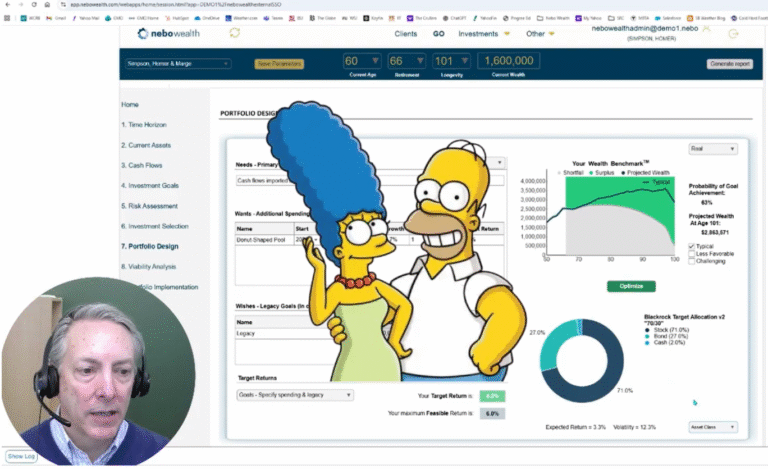

In this 1-minute video, Matthew Kadnar, CFA explains how Nebo helps firms evolve their approach to private markets, including how to size allocations across both evergreen funds and drawdown vehicles.

#goalsbasedinvesting #privateoptimization #alternatives