How Much Alternatives Should a Client Own?

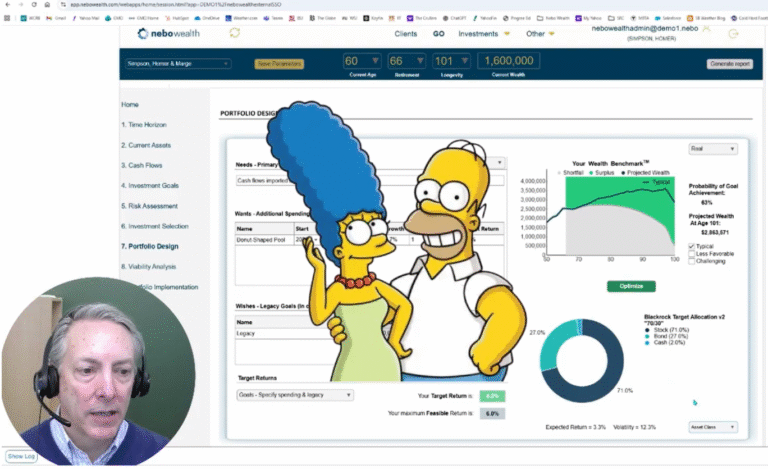

An advisor said something to Matthew Kadnar, CFA that he thought was incredibly powerful. “I don’t need another private equity fund. What I need is a tool to help me determine how much of those alts I should own for each of my clients.”

As alternatives take up a larger share of client portfolios, firms need a way to determine appropriate allocations, justify them, and defend them when it matters most.

In this 3-minute clip from Whiskey & WealthTech with Alex Serman, CIPM First Rate, Inc, Matthew Kadnar, CFA and Martin Tarlie, the conversation turns to how firms can build institutional-grade frameworks for alternatives that seek to improve decisions, oversight, and client outcomes.

#goalsbasedinvesting #privateoptimization #alternatives