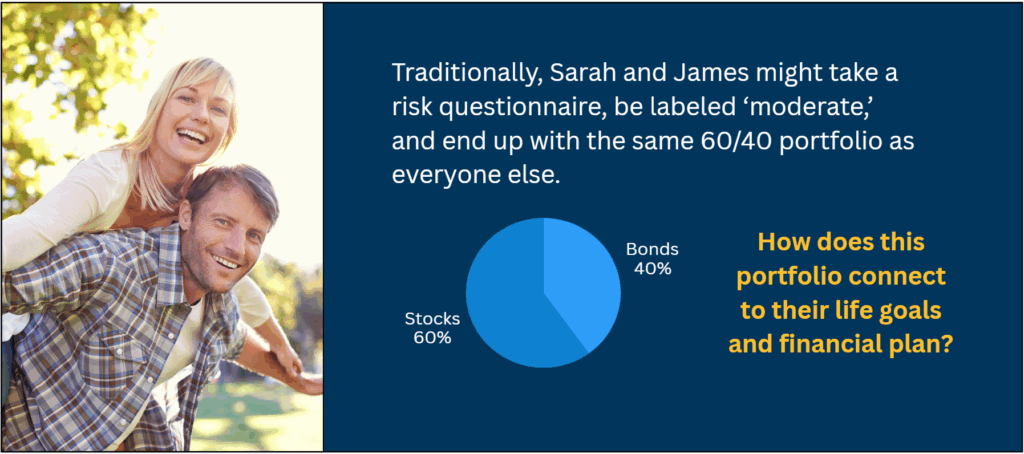

Where Are Goals in Risk Scores?

Why client lives can’t be reduced to a single number

Adam Scully-Power, Practice Solutions Director, Nebo Wealth

Andy Finnegan, Marketing Lead, Nebo Wealth

Key Takeaways

1. Risk scores reduce complex lives to a single number that can’t capture goals.

2. Portfolios built on risk scores treat different families as if they were the same.

3. Real risk is not volatility. It’s missing milestones that matter most to clients.

4. “I haven’t seen anyone talk about this. The very idea of Risk Tolerance is not just overused, it is incorrect from the get-go. We financial planners/investment advisors preach rational, rather than emotional investing. Yet, the fundamentals of our portfolio structure include an expectation of emotional misbehavior. Why do we encourage that which we discourage?” — Financial Advisor, Nebo webinar

5. “The cost of suboptimal financial planning and investing isn’t quantified in dollars and cents. It’s time you sacrifice with friends and family. It’s an extra 5 years working a job that controls your life. It’s a life of average experiences instead of unforgettable ones.” –– Matthew Garasic, CFP®