The Paradox of Choice in Model Marketplaces

Why More Options Are Making It Harder Why More Options Are Making It Harder for Advisors to Deliver Better Outcomes

Adam Scully-Power, Practice Solutions Director, Nebo Wealth

If you’re an advisor managing client portfolios, you’ve probably faced this dilemma:

- Your model marketplace offers hundreds of options, far more than you could ever evaluate.

- Clients expect personalized investment strategies, but you’re limited to choosing from static model portfolios built for generic risk profiles.

- You know risk scores alone don’t tell the full story, but what’s the alternative?

The rise of model portfolios and the platforms that make them available was supposed to make investment management easier. Instead, it has complicated decision- making, created inefficiencies, and forced advisors to navigate a sea of choices without clear guidance.

More options don’t always lead to better decisions.

That’s why the next generation of model marketplaces is different.

The Rise of Model Marketplaces: The Rise of Model Marketplaces: Benefits and Challenges

Model marketplaces emerged as a solution to help advisors scale investment management. Instead of constructing portfolios from scratch, advisors could select from professionally managed models, saving time while ensuring clients had diversified, research-backed allocations. In theory, more choices meant more flexibility, allowing advisors to tailor investment solutions to different client needs.

But in practice, something else happened:

- Too many choices, too little clarity. Today’s model marketplaces are overflowing with options. Hundreds of portfolios, each promising different risk- return characteristics, make it difficult to know which is truly best for any given client.

- Risk tolerance is a blunt instrument. The dominant selection method, assigning clients to models based on a risk tolerance questionnaire, fails to capture real-life financial complexities.

- Decision fatigue sets in. Advisors want to provide the best solutions for their clients, but when faced with too many choices, second-guessing becomes inevitable. Instead of gaining efficiency, many advisors feel overwhelmed and burdened by the sheer effort required to make an informed decision.

“The next generation of model marketplaces will incorporate advanced goals-based portfolio construction tools, empowering advisors to navigate hundreds of options and precisely match each client’s unique goals with the optimal model portfolio.”

This dynamic isn’t unique to financial advisors. A well-known study on consumer behavior found that shoppers presented with 24 flavors of jam were far less likely to make a purchase than those given just six options. 1

Too much choice can lead to hesitation, confusion, and, ultimately, inaction. The same paradox plays out in model marketplaces, when advisors are presented with an overwhelming number of portfolios, the difficulty of choosing can lead to suboptimal outcomes.

It’s the classic paradox of choice: more options don’t always make things better. They often make it harder to act with confidence.

The Future of Model Marketplaces: The Future of Model Marketplaces: Clarity Over Choices

The future of model marketplaces isn’t about offering more choices, it’s about making the right choice clearer.

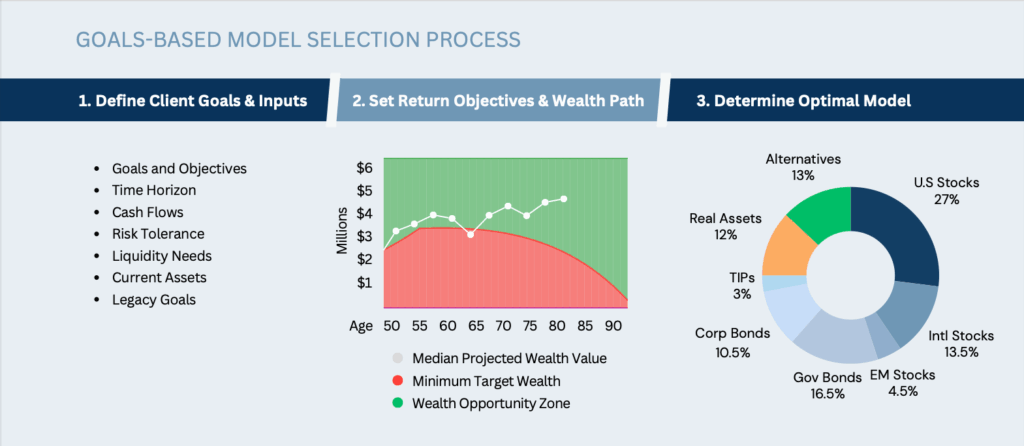

Instead of starting with risk tolerance, modern model selection should focus on the client’s goals, time horizons, expected cash flow, and liquidity needs.

Here’s how it works:

- Start with the right inputs: Focus on a client’s goals, time horizons, expected cash flows, and liquidity needs, not just their risk score.

- Leverage wealth optimization: Use a dynamic process to determine the required return and wealth levels needed. From there, identify the optimal portfolio allocation that aligns with the client’s financial objectives.

- Match to the optimal model: Whether using third-party strategies, home office models, or a unified managed account (UMA) framework, match the client’s portfolio allocation requirements to the optimal model from the marketplace.

The result? A modern model marketplace that cuts through the noise, empowering advisors to help clients reach their goals with clarity and confidence.

Case Study 1: Finding the Right Case Study 1: Finding the Right Portfolio for the Right Goals

Meet Sarah and James, a couple in their mid- 40s with strong incomes. Their primary financial goals are to fund their children’s college tuition and retire in their early 60s. When they meet with their financial advisor, Alex, they have one key question: “Are we on track?”

For illustration purposes only. Not all asset classes represented in the portfolio allocation may be appropriate for all investors.

Traditionally, Alex might begin with a risk tolerance questionnaire, likely categorizing Sarah and James into a “moderate growth” model. However, Alex understands that this approach may not fully address their unique goals. Instead, he employs a goals-based investment approach to create a personalized portfolio aligned with their specific financial needs.

Here’s how Alex approaches the problem:

- Evaluating Cash Flow Needs: With tuition withdrawals expected in 10–15 years, Alex ensures that the portfolio structure provides the necessary liquidity for these expenses while maintaining long-term growth potential for their retirement assets.

- Assessing Required Return: Alex calculates the rate of return Sarah and James need to meet their tuition funding schedule and early retirement timeline. This ensures that their investment strategy aligns directly with their financial objectives.

- Selecting an Optimal Portfolio: Alex selects the “best-fit” model from the goals-based model marketplace. This portfolio aligns asset allocation with Sarah and James’ personalized financial plan to maximize their chances of financial success.

The result? By moving beyond a generic risk- based approach and leveraging goals-based optimization, Alex ensures that Sarah and James’ portfolio is structured to achieve their specific financial milestones. This tailored strategy provides them with confidence and clarity, knowing that their investments are aligned with what truly matters, their children’s education and their dream of early retirement.

Case Study Profile: Sarah and James

Clients: Mid 40s

Planned Retirement Age: Early 60s

Financial Goals: Sell business in 10 year and transition into retirement

Business Value: 25% of total net worth

Risk Profile: Moderate

For illustration purposes only. Not all asset classes represented in the portfolio allocation may be appropriate for all investors.

Case Study 2: A Bespoke Portfolio Strategy for Complex Client Needs

Now, consider Michael, a 55-year-old business owner with 25% of his net worth tied up in his privately-owned business. His goal is to sell the business in 10 years and transition into retirement. Until then, Michael wants to ensure his liquid portfolio is optimally allocated to account for the concentrated and illiquid nature of his business asset.

Michael approaches his advisor, Lisa, with a key question: “How should my portfolio be structured given my business exposure and retirement timeline?”

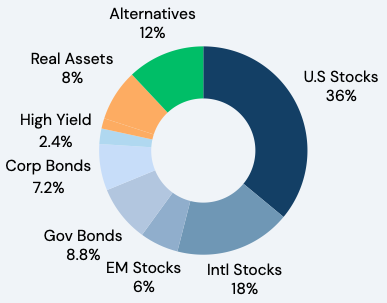

Traditionally, an advisor might start with a standard risk tolerance questionnaire and suggest a “balanced growth” model. But Lisa understands that Michael’s situation is unique. Rather than relying on a single multi- asset model, she uses a goals-based optimization strategy to craft a bespoke strategy, selecting and integrating single asset-class models tailored to Michael’s specific needs.

Here’s how Lisa approaches the process:

- Evaluating Business Risk: Recognizing that Michael’s business is both illiquid and subject to market and industry volatility, Lisa ensures that the liquid portfolio acts as a counterbalance, diversified and structured to mitigate overall risk.

- Assessing Required Return: Lisa calculates the return Michael needs from his liquid portfolio to maintain his lifestyle now and in retirement, considering the expected sale proceeds from his business in 10 years.

- Building a Bespoke Portfolio: Instead of selecting a single multi-asset model, Lisa blends single-asset class models to create a custom allocation tailored to Michael’s needs. Given the micro-cap equity-like risk profile of his business, she reduces exposure to public equities in his liquid portfolio, favoring fixed income and alternative assets to provide enough liquidity to support Michael’s lifestyle in the interim while positioning for long- term growth.

Case Study Profile: Michael

Client: 55-Year-Old Business Owner

Planned Retirement Age: 65

Children: 2 (ages 6 and 8)

Financial Goals: Fund children’s college tuition and accumulate savings for retirement

Risk Profile: Moderately Aggressive

For illustration purposes only. Not all asset classes represented in the portfolio allocation may be appropriate for all investors.

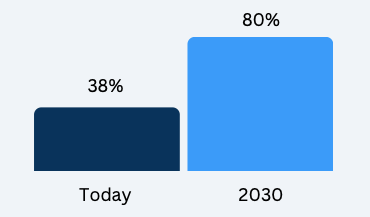

The Shift to Goals-Based Investing 2

The move toward goals-based investing is not just an emerging trend, it’s becoming an industry standard. According to industry research:

- Financial planning is now the dominant advisory model. Advisors are shifting away from an investment-first mindset and toward holistic, goal-oriented financial planning.

- Most portfolios are still disconnected from financial plans. Traditional model marketplaces rely on static risk assessments rather than integrating dynamic client goals.

- Goals-based investing is rapidly gaining adoption. Currently, 38% of advisors utilize goals-based investing, but this number is expected to rise to 80% by 2 2030.

- Major wealth managers are leading the charge. Five of the ten largest global wealth management firms now incorporate goals-based investing as a core part of their strategy.

This data reinforces a critical shift: advisors who continue to rely on outdated, risk-based model selection will fall behind. The future is about dynamic, goals-driven portfolio construction.

From One-Size-Fits-All to Tailored From One-Size-Fits-All to Tailored Investment Solutions

The wealth management industry is at a turning point. Advisors no longer have to rely on static model portfolios labeled ‘conservative, ‘ ‘moderate, ‘ or ‘aggressive. ‘ Today’s clients have unique financial goals, evolving circumstances, and specific constraints that demand a more personalized, dynamic approach.

ADVISOR ADOPTION OF GOALS- BASED INVESTING SET TO SOAR 3

By embedding goals-based investing and advanced portfolio construction tools directly into model marketplaces, advisors can:

- Streamline decision-making. Reduce decision fatigue by filtering through choices efficiently.

- Build stronger relationships by demonstrating a deeper understanding of what matters most to clients.

- Align portfolios dynamically. Ensure investments evolve alongside client needs and shifting market conditions.

- Maintain control while improving outcomes. Deliver personalized investment solutions without adding operational complexity.

How Firms Benefit from Embracing Goals-Based Model Marketplaces

Model marketplaces were designed to simplify investment selection, but over time, complexity has crept back in. Firms today need a smarter, more intuitive approach, one that aligns client portfolios with real financial goals, not just generic risk labels.

So, what’s the right approach? It starts with rethinking what “fit” truly means. The right portfolio isn’t just one that matches a risk profile, it’s one that optimally supports a client’s journey toward financial success. Leveraging goals-based optimized asset allocation and a curated range of model portfolios, firms can:

- Streamline investment processes without having to sacrifice the personalization that both advisors and clients today demand.

- Reduce compliance risks by ensuring every client is mapped to the optimal model based on their unique goals.

- Scale efficiently by serving more clients without sacrificing customization or quality.

This modern approach doesn’t just improve operational efficiency, it lays the foundation for long-term growth and success. The firms that embrace this next generation of goals- based model marketplaces won’t just keep pace with industry trends, they’ll lead the charge toward a more client-centric future.

Welcome to the modern model marketplace, where wealth management firms, Registered Investment Advisors (RIAs), Broker/Dealers, Bank and Trust Companies, Insurance Companies, and Turnkey Asset Management Platforms (TAMPs) can streamline investment processes, personalize client solutions, and scale with confidence.

- Journal of Personality and Social Psychology, 2000, Vol. 79, No. 6, 995-1006, “When Choice is Demotivating: Can One Desire Too Much of a Good Thing?,” Sheena S. Iyengar Columbia University Mark R. Lepper Stanford University. ↩︎

- Datos Insights 2024 Financial Advisor Survey. ↩︎

- 38% from Datos Insights 2024 Financial Advisory Survey. 80% from a 2020 report by McKinsey &

Company, quoted in The Future of Wealth Management, The Street, 12/27/23 ↩︎

GET TO KNOW NEBO WEALTH

Nebo Wealth is a leader in goals-based investing and personalized portfolio construction. Powered by award-winning wealth optimization, it’s how advisory firms elevate the value of their advice, deliver more personalized, goals-driven portfolios, and seek to achieve better outcomes for their clients and their practice.

After a decade of research, Nebo Wealth launched in 2022 and has been recognized with numerous awards, garnered praised from industry leaders, and become a leading provider of goals-based investing solutions for advisors.

READY TO LEARN MORE?

Visit us at www.nebowealth.com to learn more or schedule a brief exploratory call and interactive demo.

IMPORTANT DISCLOSURES

The views expressed represent the opinions of Nebo Wealth, a division of GMO, LLC. which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While Nebo Wealth believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability.

This presentation is for general information and education only. Nebo Wealth makes no representations or warranties in respect of this presentation and is not responsible for the accuracy, completeness or content of information contained in this presentation. Nebo Wealth is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on any information contained in the information.

Nothing in this presentation should be construed as an offer, or solicitation of an offer, to buy or sell any financial instrument. It should not be relied upon as specific investment advice directed to the viewer’s specific investment objectives. Any financial instrument discussed on this webpage may not be suitable for the viewer. Each viewer must make his or her own investment decision, using an independent advisor if prudent, based on his or her own investment objective and financial situation.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money.

Copyright © 2025 by Nebo Wealth, a GMO LLC Company. All rights reserved.