Addressing Compliance Risk

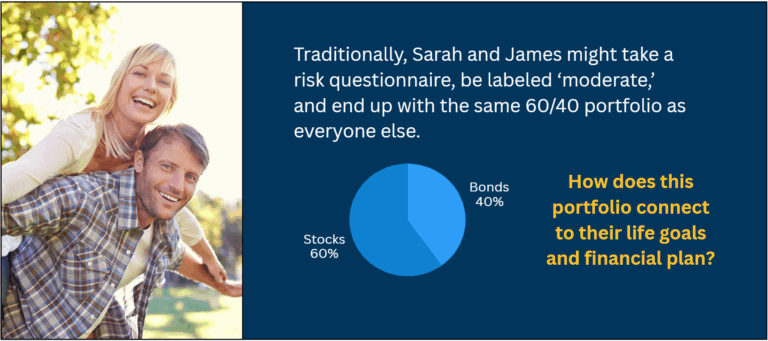

Why Is This Client in This Portfolio?

Matt Kadnar, Sales Lead, Nebo Wealth

Andy Finnegan, Marketing Lead, Nebo Wealth

Key Takeaways

1. It’s an industry challenge to ensure that the client is in the right portfolio.

It’s the kind of thing we hear often: for example, a retired couple in their late 60s and a mid-career tech executive, each with very different goals and time horizons, assigned to the same moderate model.

2. Balancing scalability and advisor autonomy is costly and complex.

“Walking the tightrope of enterprise risk management and advisor autonomy can be difficult, costly, and inefficient,” notes Vestmark (2019). While models may appeal to headquarters, top producers often expect the freedom to build their own portfolios.

3. Illiquid assets demand a more thoughtful approach to suitability.

As private investments become more common, they bring added complexity. Advisors need a way to connect these exposures to a client’s goals, time horizon, and liquidity needs, which traditional portfolio models often fail to capture.

4. Firms need a unified way to connect plans, portfolios, and client goals.

Too many still rely on ad hoc processes or static models. The challenge is solving for consistency, personalization, and scale while preserving advisor autonomy.