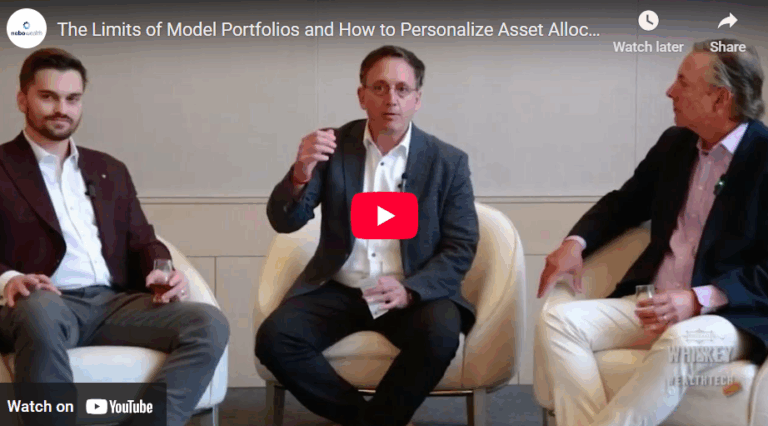

How model portfolios are evolving and what that means for advisors, platforms, and clients

We had the pleasure of hosting Matthew Apkarian, CFA and Andrew Rose from Cerulli Associates Fidelity Investments for a focused discussion on how model portfolios are evolving and what that means for advisors, platforms, and clients. Three key takeaways stood out:

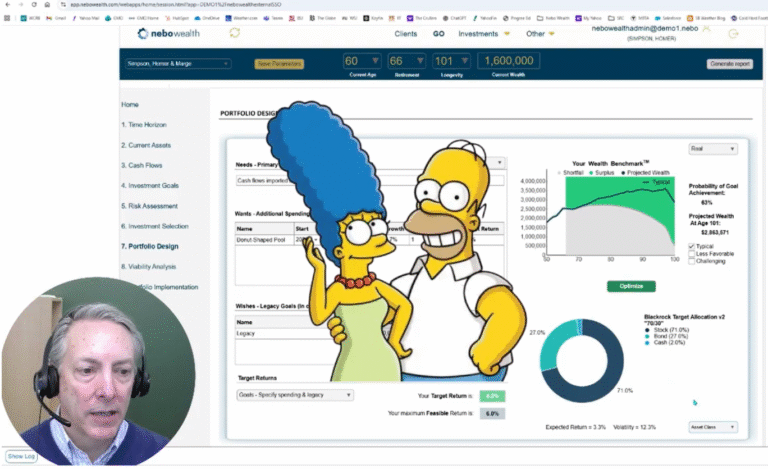

1. Custom models are the #1 priority of model providers: Enterprises are leaning into personalization as a way to deliver consistent, elevated client experiences and differentiate themselves in the marketplace.

2. The industry has grown more complex, but advisor tools haven’t: There’s a growing gap between the sophistication of today’s investment landscape and the tools most advisors have at their disposal.

3. “We’re in the business of risk allocation, not risk avoidance”: Aligning goals to models can lead to better outcomes and make it easier for advisors to coach clients through uncertainty.

Thank you for a thought-provoking conversation. We’re excited to be part of the journey toward a more client-centric future.

#GoalsBasedInvesting #WealthOptimized #ClientExperience