The real risk is you won’t have the money you need, when you need it.

What’s the real risk? For most investors, it’s not volatility. The real risk is you won’t have the money you need, when you need it.

In this conversation with RIA Channel Martin Tarlie explains why that simple idea changes everything about how we build portfolios.

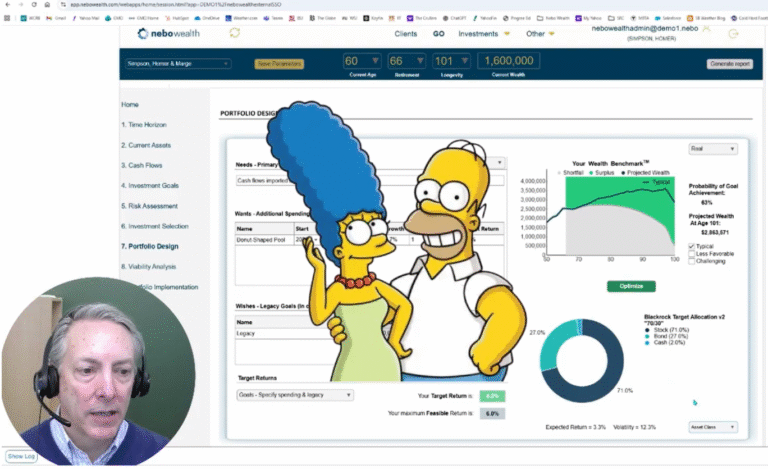

Nebo starts with the client’s wealth, time horizon, and goals. Then we optimize for the highest probability of meeting those goals.

We don’t think in terms of risk scores. We think in terms of real-world outcomes.

As Martin says: “you can’t pay your mortgage with a Sharpe Ratio.”

#GoalsBasedInvesting #WealthOptimization #Outcomes