Perfect-Fit Portfolio: Jake & Mary Ann’s Florida Dream

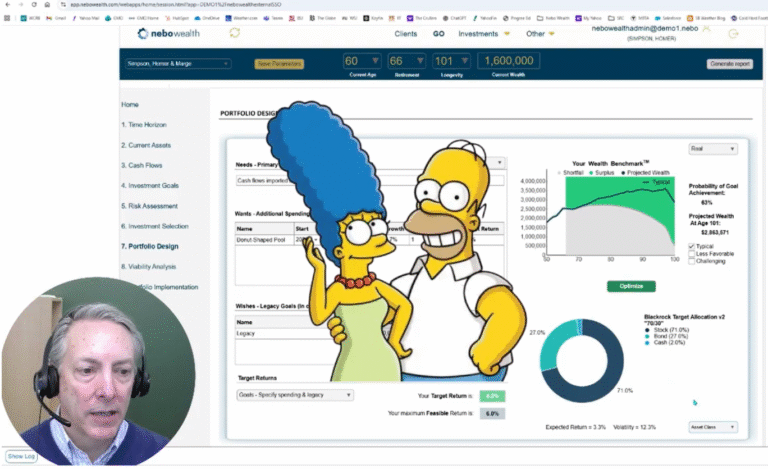

Navigating retirement is about more than numbers, it’s about turning dreams into reality. In this “Perfect Fit Portfolio” episode, Matthew Kadnar, CFA meets Jake and Mary Ann Henderson, a couple ready to trade cold Northeast winters for sunny Florida skies.

Jake & Mary Ann’s Situation:

• Ages: Both 59, planning to retire at 65 with longevity to 95

• Wealth: $2.4 million, saving $50,000 annually until retirement

• Goals:

🌞 Relocate to Florida for better weather and lower taxes

🎣 Buy a Key West 239 boat for Jake’s deep-sea fishing passion

🎓 Support their children’s college education

🏡 Leave a legacy of $1 million to their two children

Using Nebo Wealth’s advanced goals-based investing process, we guided Jake and Mary Ann through five critical steps (time horizon, risk tolerance, cash flows, legacy planning, and target return) to craft a portfolio uniquely aligned with their goals.

With a required real target return of 3.6% (after taxes, fees, and inflation), their optimized portfolio balances growth and preservation:

• 58% equities

• 20% liquid alternatives

• 22% bonds

At Nebo, we believe a portfolio should never take more or less risk than needed to achieve a client’s goals. Jake and Mary Ann’s portfolio adapts dynamically as their circumstances evolve, whether that’s a windfall inheritance or updated retirement priorities.

Watch how Nebo’s process delivers clarity and confidence, helping clients like Jake and Mary Ann achieve their dreams.

#goalsdrivenwealthmanagement #goalsbasedinvesting